Le voci che hanno preceduto l'acquisizione di Informatica da parte di Salesforce hanno indubbiamente suscitato domande. Noi di SnapLogic comprendiamo l'incertezza che si crea in questo caso. Ma non temete, abbiamo pensato a voi.

Perché Salesforce voleva acquisire Informatica

I dati sono il nome del gioco dell'intelligenza artificiale.

Nell'ultimo anno, Salesforce ha intensificato l'enfasi sui dati e sull'intelligenza artificiale con le offerte Agentforce, Data Cloud ed Einstein. Pur possedendo risorse di dati in MuleSoft e Tableau, l'acquisizione di Informatica ha il potenziale (almeno sulla carta) di elevare questo focus, facilitando una migliore sincronizzazione dei dati attraverso diversi ecosistemi per le organizzazioni. La sincronizzazione dei dati è, ovviamente, fondamentale per massimizzare il potenziale dei dati aziendali nelle applicazioni di intelligenza artificiale. È quindi ovvio che Salesforce intenda fare di Informatica un componente essenziale per completare il puzzle "Customer 360".

Anche le aziende sono state molto chiare nel comunicare la loro esigenza di un'unica piattaforma unificata. Tuttavia, l'architettura di Frankenstein che Salesforce sta assemblando è unificata solo in apparenza. In realtà richiederà un notevole lavoro di integrazione tecnica, anche se verrà venduta come un insieme unificato. In realtà, potremmo assistere al risultato opposto, con Informatica inserita in accordi con Salesforce che sono legati solo tenuamente, se non del tutto, ai suoi casi d'uso. Abbiamo già assistito a questo accorpamento forzato con altri recenti annunci di prodotti Salesforce, sbandierati come inclusi in migliaia di accordi, ma senza alcun impatto misurato.

Poiché Salesforce intende sviluppare un maggior numero di soluzioni GenAI, saranno necessarie grandi quantità di dati dei clienti per alimentarle. Sebbene alcuni ritengano che l'approccio migliore sia quello di collaborare con un hyperscaler o con una delle tante soluzioni che iniziano concentrando tutto in un unico luogo (e pulendolo ed elaborandolo per renderlo adatto all'uso), le aziende hanno bisogno di accedere a tutti i tipi di dati, applicazioni e API, non solo a ciò che è disponibile in una piattaforma, per quanto ampia e profonda. Piuttosto che collaborare con innumerevoli società di dati e applicazioni, è opportuno affidarsi a un'azienda di integrazione che sia già in grado di gestire queste tecnologie.

E siamo d'accordo!

È una buona mossa?

Sebbene l'accordo abbia un certo senso in superficie, Informatica è una scelta sbagliata per Salesforce. Il data cloud di Salesforce è stato un problema, quindi questa acquisizione sembrerebbe integrare le precedenti acquisizioni di Tableau e MuleSoft, fornendo una migliore presa sui dati dei clienti. Senza una forte integrazione e gestione dei dati, c'è il rischio concreto che i fornitori di data lake catturino questa opportunità redditizia. Tuttavia, i problemi tecnici e operativi rendono questa particolare acquisizione non ideale sia per Salesforce che per Informatica.

Dal punto di vista tecnico, Informatica è già di per sé un'amalgama di numerose acquisizioni, che ha portato a un'impegnativa architettura legacy on-premises con basi di codice e interfacce eterogenee. Inoltre, Informatica è un motore di integrazione dati relazionale. Ciò significa che la gestione dei dati semi-strutturati e non strutturati, che costituiscono la maggior parte dei dati dei clienti e che sono fondamentali per l'IA generativa, non è un punto di forza della piattaforma Informatica. Dal punto di vista operativo, Salesforce dovrebbe trovare un'architettura mirata, razionalizzare i portafogli sovrapposti, fornire indicazioni ai clienti su quando utilizzare quali strumenti di integrazione e colmare le lacune tecniche fondamentali.

L'interesse di Salesforce per Informatica conferma la nostra convinzione di lunga data che le applicazioni e le esperienze digitali ad alte prestazioni possono essere fornite solo attraverso una combinazione di integrazione dei dati e delle applicazioni. L'intelligenza artificiale generativa approfondisce questo modello, in quanto i carichi di lavoro GenAI mescolano intrinsecamente l'integrazione dei dati e delle applicazioni. Data l'ampiezza delle sfide di integrazione e l'incertezza della roadmap, i clienti di Informatica farebbero bene a iniziare a esplorare alternative moderne, stabili e innovative come SnapLogic. Soprattutto quelle costruite da zero per essere un servizio completo, unificato e unico per l'integrazione.

Vantaggi strategici di SnapLogic

Ecco perché SnapLogic si distingue:

Neutralità: A differenza di Salesforce, che darà priorità ai propri prodotti e dovrà affrontare un maggiore attrito con i concorrenti, SnapLogic rimane indipendente. Diamo priorità alle integrazioni su misura per le vostre esigenze specifiche, indipendentemente dal fornitore. Questa flessibilità e la sicurezza per il futuro salvaguardano il vostro ambiente di dati.

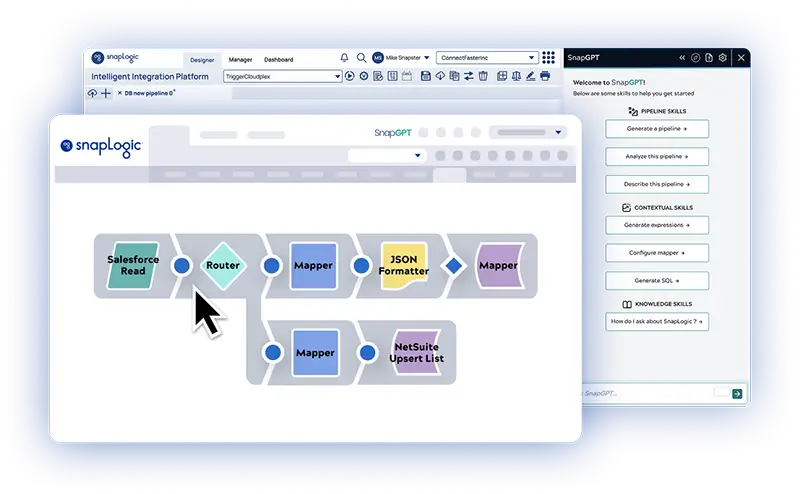

Architettura ed esperienza utente unificate: A differenza del confuso mix di codebase, interfacce e cicli di rilascio risultanti dalle acquisizioni di MuleSoft e Informatica, SnapLogic fornisce un'architettura cloud unificata che combina l'integrazione di dati e applicazioni, la gestione delle API e lo sviluppo di applicazioni GenAI in un'unica piattaforma con un unico ambiente e un'unica interfaccia. Questo si traduce in una gestione più semplice, in un'implementazione più rapida e in una riduzione dei costi.

Percorso di migrazione senza soluzione di continuità: La migrazione al cloud di Informatica può essere scoraggiante. Molte aziende leader hanno scelto il processo di migrazione più agevole di SnapLogic. I nostri partner, come EXL, offrono valutazioni e percorsi di migrazione gratuiti per semplificare la transizione.

Prezzi prevedibili: Il modello di prezzi a consumo di Informatica crea incertezza sul budget. I pacchetti dati illimitati di SnapLogic garantiscono la tranquillità di costi chiari e prevedibili.

Sicurezza dei dati: Se Salesforce intende utilizzare questa acquisizione per sfruttare i dati dei clienti per l'addestramento di modelli di intelligenza artificiale, potrebbe incontrare la resistenza dei clienti che non vogliono che i loro dati vengano utilizzati in questo modo.

Costruito per l'era AI/GenAI: SnapLogic è stato progettato da zero per gestire i dati ricchi, semi-strutturati e non strutturati richiesti dalle applicazioni SaaS e dai progetti GenAI, mentre MuleSoft e Informatica sono stati progettati per un'epoca passata di dati strutturati e on-premise.

- Siamo leader nell'innovazione GenAI. SnapGPT, generalmente disponibile da luglio 2023, consente integrazioni attraverso il linguaggio naturale, mentre ClaireGPT di Informatica rimane in anteprima.

- AgentCreator, generalmente disponibile da gennaio 2024, consente a chiunque di creare potenti applicazioni LLM senza bisogno di codifica, una capacità non offerta da Informatica.

Cosa c'è dopo?

Se queste indiscrezioni sono vere, sarà interessante vedere come le due aziende affronteranno tutto ciò che è stato evidenziato sopra. Ma si tratta solo di voci e l'accordo non è certo.

Ciò che è certo è che l'IA generativa è pronta a trasformare il mercato dell'integrazione tradizionale. McKinsey prevede che il mercato passerà da un TAM (mercato totale indirizzabile) di 100 miliardi di dollari a 1,5 miliardi di dollari, dato che quasi tutte le aziende moderne si trovano ad affrontare una pressione immensa per produrre più output con meno risorse.

Avevamo previsto questa domanda e negli ultimi due anni abbiamo investito molto nelle soluzioni GenAI. Mentre questo settore esplode con nuove possibilità, continueremo a fornire soluzioni GenAI tangibili ai nostri clienti e partner.