Die Gerüchte im Vorfeld der Übernahme von Informatica durch Salesforce haben zweifellos Fragen aufgeworfen. Wir bei SnapLogic verstehen die Unsicherheit, die durch solche Schritte entsteht. Aber keine Sorge, wir haben für Sie vorgesorgt.

Warum Salesforce Informatica übernehmen wollte

Daten sind das A und O bei der KI.

Im vergangenen Jahr hat Salesforce mit seinen Agentforce-, Data Cloud- und Einstein-Angeboten seinen Schwerpunkt auf Daten und KI verstärkt. Obwohl das Unternehmen mit MuleSoft und Tableau bereits über Datenressourcen verfügt, hat die Übernahme von Informatica (zumindest auf dem Papier) das Potenzial, diesen Fokus zu verstärken und eine verbesserte Datensynchronisierung über verschiedene Ökosysteme hinweg für Unternehmen zu ermöglichen. Die Datensynchronisierung ist natürlich von zentraler Bedeutung für die Maximierung des Potenzials von Unternehmensdaten in KI-Anwendungen. Es liegt also die Vermutung nahe, dass Salesforce beabsichtigt, Informatica als wichtige Komponente bei der Vervollständigung des "Customer 360"-Puzzles einzusetzen.

Auch die Unternehmen haben ihren Bedarf an einer einzigen, einheitlichen Plattform sehr deutlich zum Ausdruck gebracht. Die Frankenstein-Architektur, die Salesforce zusammenstellt, ist jedoch nur an der Oberfläche einheitlich. Sie erfordert in der Tat einen erheblichen technischen Integrationsaufwand, auch wenn sie als einheitliches Ganzes verkauft wird. Es ist sogar möglich, dass das gegenteilige Ergebnis eintritt und Informatica in Salesforce-Geschäfte eingebunden wird, die, wenn überhaupt, nur in geringem Maße mit den Anwendungsfällen von Salesforce zusammenhängen. Wir haben diese erzwungene Bündelung bereits bei anderen Salesforce-Produktankündigungen der letzten Zeit gesehen, die als Bestandteil von Tausenden von Geschäften angepriesen wurden - jedoch ohne jede messbare Wirkung.

Da Salesforce mehr GenAI-Lösungen entwickeln möchte, werden riesige Mengen an Kundendaten benötigt, um sie zu betreiben. Während einige davon ausgehen, dass der beste Ansatz darin besteht, mit einem Hyperscaler oder einer der vielen Lösungen zusammenzuarbeiten, die zunächst alles an einem Ort konzentrieren (und es dort bereinigen und verarbeiten, um es für die Nutzung fit zu machen), benötigen Unternehmen Zugang zu allen Arten von Daten, Anwendungen und APIs, nicht nur zu dem, was auf einer Plattform verfügbar ist, egal wie breit und tief. Anstatt mit zahllosen Daten- und Anwendungsunternehmen zusammenzuarbeiten, ist es sinnvoll, ein Integrationsunternehmen zu beauftragen, das sich bereits mit diesen Technologien auskennt.

Und wir sind einverstanden!

Ist dies ein guter Schritt?

Obwohl die Übernahme oberflächlich betrachtet Sinn macht, ist Informatica eine schlechte Wahl für Salesforce. Die Datenwolke von Salesforce hat sich als schwierig erwiesen, so dass diese Übernahme die früheren Übernahmen von Tableau und MuleSoft zu ergänzen scheint, indem sie einen besseren Zugriff auf die Kundendaten ermöglicht. Ohne eine starke Datenintegration und -verwaltung besteht die reale Gefahr, dass Data-Lake-Anbieter diese lukrative Chance ergreifen. Aufgrund technischer und betrieblicher Probleme ist diese Übernahme jedoch sowohl für Salesforce als auch für Informatica nicht gerade ideal.

Was die technische Seite betrifft, so ist Informatica selbst bereits ein Zusammenschluss zahlreicher Übernahmen, was zu einer anspruchsvollen lokalen Legacy-Architektur mit unterschiedlichen Codebasen und Schnittstellen geführt hat. Darüber hinaus ist Informatica in seinem Kern eine relationale Datenintegrationsmaschine. Das bedeutet, dass die Verwaltung halbstrukturierter und unstrukturierter Daten, die den Großteil der Kundendaten ausmachen und für generative KI entscheidend sind, nicht zu den Stärken der Informatica Plattform gehört. In operativer Hinsicht müsste Salesforce einen architektonischen Schwerpunkt setzen, sich überschneidende Portfolios rationalisieren, den Kunden eine Anleitung geben, wann welches Integrationstoolset zu verwenden ist, und grundlegende technische Lücken schließen.

Das Interesse von Salesforce an Informatica bestätigt unsere langjährige Überzeugung, dass leistungsstarke digitale Anwendungen und Erlebnisse nur durch eine Kombination aus Datenintegration und Anwendungsintegration bereitgestellt werden können. Generative KI vertieft dieses Muster, da GenAI-Workloads von Natur aus Daten- und Anwendungsintegration miteinander verbinden. Angesichts des Ausmaßes der Integrationsherausforderungen und der unsicheren Roadmap wäre es für Informatica Kunden ratsam, sich mit modernen, stabilen und innovativen Alternativen wie SnapLogic auseinanderzusetzen. Vor allem solche, die von Grund auf als einheitlicher Full-Service-Anbieter für die Integration konzipiert wurden.

Strategische Vorteile von SnapLogic

Hier ist der Grund, warum SnapLogic so besonders ist:

Neutralität: Im Gegensatz zu Salesforce, das seinen eigenen Produkten den Vorrang gibt und sich mit seinen Wettbewerbern auseinandersetzen muss, bleibt SnapLogic unabhängig. Wir priorisieren Integrationen, die auf Ihre spezifischen Bedürfnisse zugeschnitten sind, unabhängig vom Anbieter. Diese Flexibilität und Zukunftssicherheit sichert Ihre Datenumgebung.

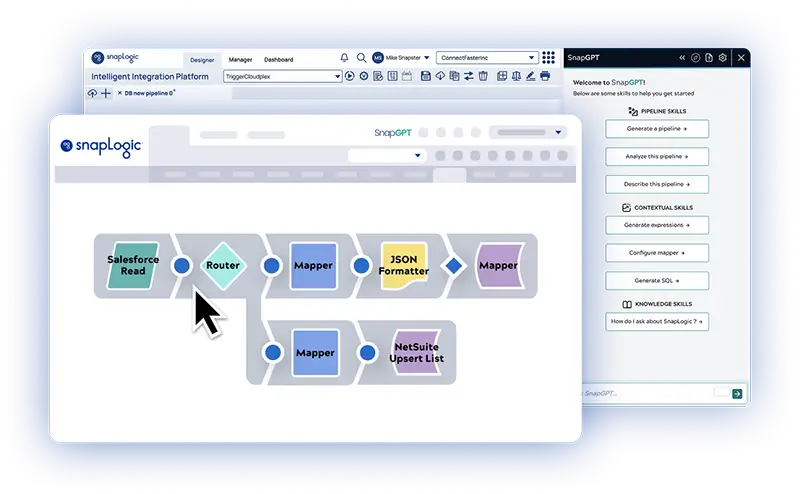

Einheitliche Architektur und Benutzerfreundlichkeit: Im Gegensatz zu der verwirrenden Mischung aus Codebases, Schnittstellen und Release-Zyklen, die aus den Übernahmen von MuleSoft und Informatica resultiert, bietet SnapLogic eine einheitliche Cloud-native Architektur, die Daten- und Anwendungsintegration, API-Management und GenAI-Anwendungsentwicklung in einer einzigen Plattform mit einer einzigen Umgebung und Schnittstelle vereint. Dies führt zu einer einfacheren Verwaltung, schnelleren Implementierung und niedrigeren Kosten.

Nahtloser Migrationspfad: Die Migration zur Informatica Cloud kann entmutigend sein. Viele führende Unternehmen haben sich für den reibungsloseren Migrationsprozess von SnapLogic entschieden. Unsere Partner wie EXL bieten kostenlose Bewertungen und Migrationspfade an, um Ihren Übergang zu vereinfachen.

Vorhersehbare Preisgestaltung: Das verbrauchsabhängige Preismodell von Informatica schafft Budgetunsicherheit. Die unbegrenzten Datenpakete von SnapLogic sorgen für Sicherheit durch klare, vorhersehbare Kosten.

Datensicherheit: Wenn Salesforce beabsichtigt, diese Übernahme zu nutzen, um Kundendaten für das Training von KI-Modellen zu verwenden, könnte es auf den Widerstand von Kunden stoßen, die nicht wollen, dass ihre Daten auf diese Weise verwendet werden.

Gebaut für die KI/GenAI-Ära: SnapLogic wurde von Grund auf für den Umgang mit umfangreichen, halbstrukturierten und unstrukturierten Daten entwickelt, die für SaaS-Anwendungen und GenAI-Projekte erforderlich sind, während MuleSoft und Informatica für eine vergangene Ära von On-Premises und strukturierten Daten konzipiert wurden.

- Wir sind führend in der GenAI-Innovation. SnapGPT ist seit Juli 2023 allgemein verfügbar und ermöglicht Integrationen durch natürliche Sprache, während ClaireGPT von Informatica noch in der Vorschau ist.

- AgentCreatorDer AgentCreator, der seit Januar 2024 allgemein verfügbar ist, ermöglicht es jedem, leistungsstarke LLM-gestützte Anwendungen ohne Programmierung zu erstellen - eine Fähigkeit, die von Informatica nicht angeboten wird.

Was kommt als Nächstes?

Sollten sich diese Gerüchte bewahrheiten, wird es interessant sein zu sehen, wie die beiden Unternehmen mit den oben genannten Punkten umgehen werden. Aber das sind alles nur Gerüchte, und das Geschäft ist nicht sicher.

Sicher ist, dass die generative KI den traditionellen Integrationsmarkt verändern wird. McKinsey geht davon aus, dass der Markt von 100 Mrd. $ TAM (total addressable market) auf 1,5 T. $ ansteigen wird, da fast alle modernen Unternehmen unter dem immensen Druck stehen, mehr Leistung mit weniger Ressourcen zu produzieren.

Wir haben diese Nachfrage vorausgesehen und in den letzten zwei Jahren stark in GenAI-Lösungen investiert. Während diese Branche mit neuen Möglichkeiten explodiert, werden wir unseren Kunden und Partnern weiterhin konkrete GenAI-Lösungen liefern.