La clôture du mois est l'un des processus les plus critiques et les plus pénibles de la finance.

Le rapprochement des données contractuelles, des enregistrements CRM et des systèmes de facturation est lent, manuel et source d'erreurs. Pour notre équipe financière chez SnapLogic, cela signifiait passer plus de 40 heures par mois à valider manuellement les formulaires de commande des clients par rapport aux données Salesforce, sans pouvoir s'appuyer sur une source unique de vérité.

Dans le deuxième épisode de notre série de webinar Agentic Builders, je me suis associé à Nicole Houts, Senior Finance Manager, pour montrer comment nous avons relevé ce défi en créant un flux de travail agentique pour la finance.

Les résultats : une réduction de 90% du temps de révision manuelle, une clôture mensuelle 30% plus rapide, et même 2% de revenus annuels récupérés.

Le défi financier

Nicole a fait part des difficultés rencontrées par notre équipe financière :

- Rapprochement manuel entre les opportunités de Salesforce et les contrats PDF stockés dans Box

- Plus de 40 heures par mois perdues en validation fastidieuse et en correction d'erreurs

- Systèmes fragmentés sans source unique de vérité pour les données financières critiques

- Risque d'erreur et de perte de recettes lié au recours à des contrôles manuels

Comme l'a dit Nicole au cours de la session, "chaque fois que vous avez des processus manuels, ils sont sujets à des erreurs" : "Chaque fois que vous avez des processus manuels, ils sont sujets à des erreurs. Il peut en résulter des rapports incorrects et même des fuites de revenus - ce qui n'est pas l'idéal pour une équipe financière".

L'objectif était clair : gagner du temps, améliorer la précision et libérer l'équipe financière pour qu'elle se concentre sur des tâches plus stratégiques et à plus forte valeur ajoutée.

Construire le flux de travail agentique de Finance

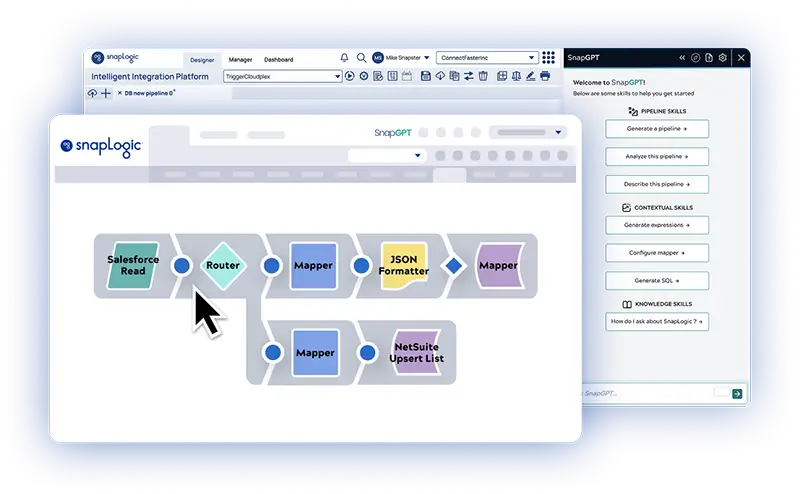

Pour résoudre ce problème, nous avons conçu un agent financier alimenté par la plateformeintégration agentique de SnapLogic. Voici comment nous avons procédé :

- L'interface : Nous avons construit l'agent sur Streamlit, en fournissant une interface simple, de type chat, pour que les utilisateurs de la finance puissent lancer des rapprochements, examiner les résultats et procéder à des itérations rapides.

- Architecture : Le modèle pilote-travailleur de SnapLogic nous a permis d'orchestrer les LLM avec le contexte de l'entreprise tout en gardant les humains dans la boucle si nécessaire.

- Outils connectés :

- Salesforce pour les données relatives aux opportunités et aux revenus

- Boîte pour les bons de commande des clients

- Sorties Excel pour les rapports de réconciliation

le workflow commence par la récupération des opportunités conclues dans Salesforce, l'extraction des formulaires de commande associés dans Box et le rapprochement des données financières clés. Les divergences sont signalées instantanément, des liens vers les enregistrements sont fournis pour une validation rapide, et les résultats peuvent être examinés dans Excel ou directement dans l'interface de l'agent.

Points forts de la démonstration

Lors de la démonstration en direct, nous avons montré la rapidité avec laquelle l'agent pouvait.. :

- Récupérer les opportunités de renouvellement à partir de Salesforce et fournir des liens d'enregistrement directs

- Renvoi aux bons de commande stockés dans la boîte

- Mettre en évidence les incohérences entre les données financières des différents systèmes

- Générer des rapports de réconciliation consolidés en Excel pour examen final

Comme l'a dit Nicole lors de la session : "Nous sommes déjà à des années-lumière de ce que nous faisions auparavant. Le simple fait de pouvoir voir les opportunités avec des liens et des données réconciliées en un seul endroit nous fait gagner beaucoup de temps".

Impact sur les entreprises

Les résultats de la mise en production de ce flux de travail ont été significatifs :

- Réduction de 90 % du temps de révision manuelle

- Clôture mensuelle 30 % plus rapide

- 2 % des recettes annuelles récupérées grâce à des écarts qui, autrement, n'auraient pas été détectés

Tout aussi important peut-être, l'équipe financière est passée de la saisie fastidieuse de données à une analyse et à une prise de décision à plus forte valeur ajoutée. En automatisant la réconciliation, nous avons redonné du temps aux personnes les plus proches de l'entreprise.

Leçons apprises en cours de route

Ce projet a permis de dégager deux grandes idées :

- Il est essentiel de creuser les détails. Une conception réussie de l'agent commence par une compréhension approfondie du processus commercial et des points douloureux. Travailler en étroite collaboration avec Nicole et l'équipe financière nous a permis de découvrir les étapes granulaires où l'automatisation pouvait apporter le plus de valeur.

- N'ayez pas peur de remettre en question le statu quo. Au fur et à mesure que nous construisions le workflow, nous avons découvert des inefficacités dans le processus lui-même. En rationalisant et en repensant les étapes, nous avons non seulement amélioré l'agent, mais aussi l'ensemble des opérations.

Une surprise : l'agent n'a pas seulement gagné du temps. Il a permis de découvrir des recettes manquées. C'est le genre de résultat qui transforme un bon projet en un projet transformateur.

Perspectives d'avenir

Construire des les workflows agentiques peut sembler intimidant. Par où commencer ? Comment concevoir quelque chose auquel les utilisateurs professionnels et les équipes techniques feront confiance ? Ce projet a prouvé que SnapLogic permet de faire facilement ce premier pas. En connectant des sources de données critiques telles que Salesforce et Box, vous créez un tremplin vers le succès. À partir de là, les workflows évoluent : ajout d'outils, itération sur les invites et passage à la production.

Ce cas d'utilisation en finance n'est qu'un début. Nous travaillons déjà sur d'autres agents dans les domaines de la finance et de la comptabilité, et les possibilités sont immenses. Le message le plus important est le suivant : il n'est pas nécessaire de faire bouillir l'océan pour tirer profit de l'IA. Commencez par les données dont vous disposez déjà, connectez-les à SnapLogic et laissez l'intégration agentique faire le gros du travail.

Si vous êtes curieux d'en savoir plus sur la façon de construire votre propre flux de travail agentique et si vous avez besoin d'inspiration pour commencer, inscrivez-vous à notre prochain webinar Agentic Builders ou regardez les enregistrements.