Previously published on globalbankingandfinance.com.

The old adage that the finance department spends 90 percent of their time acquiring, cleaning up, validating and verifying data—and 10 percent analysing it—still holds true in many organisations. This is often due to technology systems and applications that don’t “speak” to each other.

This sorry state of affairs can no longer be tolerated, not at a time when digital data is approaching colossal proportions. Business should be reaping the benefits of data, yet in their strategic planning and for their tactical business decisions, companies are yet to leverage data to its full potential.

Our recent research supports this and shows 82% of IT decision-makers in financial services agree that they have more data than ever before but are struggling to harness it to generate useful business insights. However, it’s not all doom and gloom as 94% realise the need to utilise data better and become more data-driven in order to push ahead of competitors. But the questions lies in who is responsible for making this change?

In most organisations there’s a desire from the finance department to be seen as a strategic partner to the business, using trusted data to help inform critical business decisions around everything from new products to possible acquisitions and entering new markets. As the leader of this team, most companies expect their CFOs to be a business partner to the rest of the organisation, not just cutting cheques for lines of business to acquire technology tools, but ensuring all these tools are connected to generate a fluid flow of information which will drive business momentum. However, a big challenge is the extraordinary upsurge in cloud-based business applications for sales, HR, customer service, spend management, subscription billing, quote and order management, and ERP systems.

Visually, these dozens of applications resemble a bar chart—a series of siloes disconnected from each other. Out of the box, they promise a modicum of integration, but the truth is their endpoints behave differently. Consequently, IT specialists have to manually upload and download data from one application into another, a wearying process that consumes substantial time that can be dedicated to more value-added tasks.

In fact, this survey from Adaptive Insights affirms that CFOs are eager to dedicate more of their time to more strategic pursuits, but are thwarted in this mission by data integration difficulties. Six in ten CFOs cited data integration as the “primary technology hurdle” standing in the way of “gaining actionable information,” necessitating “manual data aggregation that eats up time and leads to inaccuracies,” the report stated.

Bringing together the data

What the finance department want and need is the ability to access, integrate and analyse business data and it is clear CFOs yearn to do much more than validate, verify, and report the numbers. In order to do this, technology systems and applications need to speak to each other.

The old model of finance pulling together a couple of databases of information based on a perceived business need, and then formally requesting that IT integrate the data and develop algorithms to provide the business import must be transformed. It takes too long.

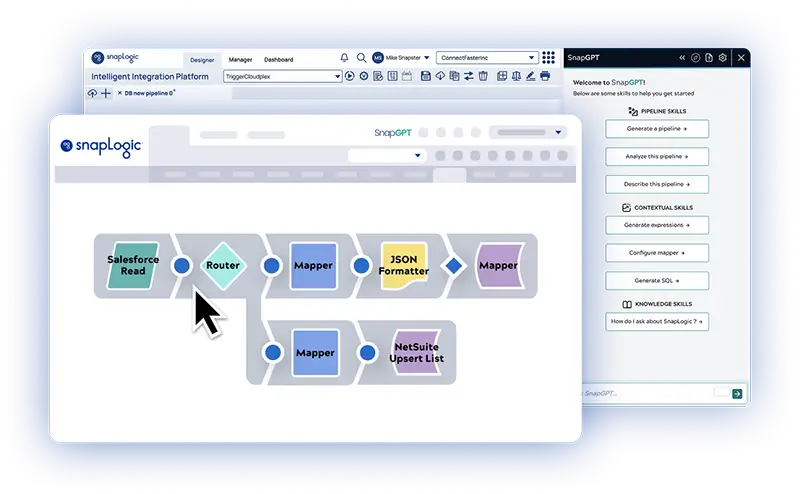

Companies can end the wait by adopting today’s modern data integration technology solutions. Yesterday’s tools were often complex, immature, difficult to manage, and frequently requiring updates that insisted upon specialised services from IT. Fortunately, the rise in technology such as big data, cloud computing and self-service are colliding to support the fluid flow of business data across on-premise and cloud-based applications.

Instant answers to database queries are required in order to stay productive and keep pace in today’s world of business. As integration technologies advance, CFOs will have the ability to quickly and seamlessly change applications or create advanced datasets on the fly, turning data siloes into a connected storehouse of powerful information.

Adopting these technologies will give finance faster insights into information in the simplest and most flexible ways possible. After all, data is only going to increase in volume and velocity so its important businesses have the right solutions in place in order to make it accessible and useful before it’s too late.