Closing out the financial month-end/quarter-end close is a key business process for any organization. After the end of the month/quarter, the finance team wants to close the books in a minimum number of days and make the final revenue, expenses, cash flow numbers available for financial reporting, planning, and analysis as soon as possible. Numbers from the recently closed quarter are needed for financial regulators and board of directors. On the other hand, projections for the upcoming quarters are crucial for the strategy team, investors, and the board. The month-end and quarter-end processes are especially complicated when your organization is globally distributed and when you have to recognize revenues, liabilities, and commissions in foreign currencies.

Month-end/quarter-end close involves reviewing, documenting, correcting, and reconciling all financial transactions for the previous month or quarter. While each company has its own set of closing activities, the following activities are relatively common across organizations:

- Adjusting/correcting general ledger entries or recording additional ones

- Reconciling of bank and credit card transactions with invoices and payments

- Updating accounts payable and accounts receivable

- Preparing financial reports such as balance sheets, income and cash flow statements

- Preparing for external audits by ensuring all records are complete and properly documented

- Assuring tax-compliance by filing tax returns and/or paying taxes

- Verify and record additions, disposals and depreciation of fixed assets

How does automation help?

The biggest challenge for finance and accounting teams is the volume and variety of data spread across various data silos. All that data needs to be extracted from various sources and reconciled. If done manually, the finance team ends up spending a significant amount of time and effort to extract the data, consolidate the data to create reports, close books, and provide meaningful insights to business.

Finance and accounting teams are looking for the right balance of accuracy and speed with their month-end/quarter-end processes and that’s where automation can help. Small and medium sized businesses can take anywhere from 1 to 2 weeks to close books with manual processes. For large organizations, financial close is exponentially more complex due to many product/service areas, geographies, etc. The only way large organizations can close sooner is by adding more people and even then it takes 3 to 4 weeks to close books.

With automation, organizations can easily extract data from a wide range of sources with a minimal amount of time. With automation, small and medium sized businesses can close books in just a few days while large businesses can bring down their close timelines to just 2 weeks.

Automation also helps in improving data accuracy by reducing the risk of errors due to manual data entry. It also improves collaboration between different team members and departments because they can work on the data simultaneously and finish quarter-end activities sooner.

What’s next? – continuous close

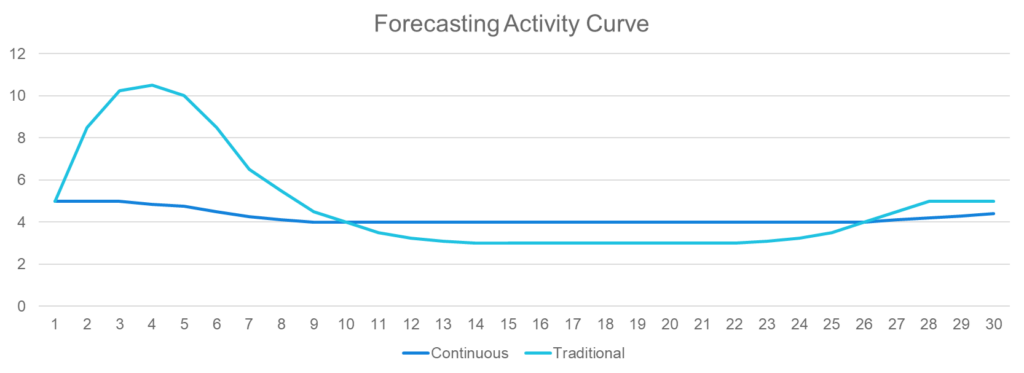

While traditionally organizations have done month-end/quarter-end close to match with the reporting cycle, in reality business is continuous. And to serve that continuous business, the close cycle should be continuous as well. Continuous close is a process enabled by technology and people where you distribute FP&A activities, automate FP&A activities, and align them to the broader business. Continuous close flattens the activity curve throughout the month. So as the business happens the close activities happen synchronously.

So why would an organization choose continuous close over a traditional monthly/quarterly close? Here are key advantages of continuous close:

- It’s efficient and collaborative

- It eliminates redundancy and errors

- It promotes data integrity

- It’s less reactive

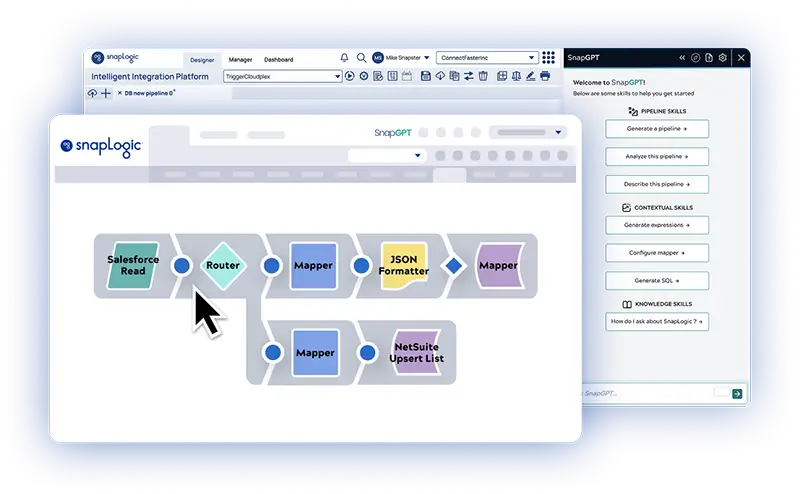

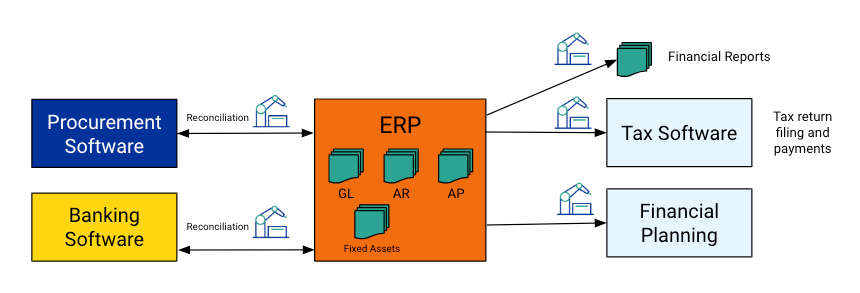

But because with continuous close, close activities happen synchronously with the business, the only way to realize them is through automation. With the right tools and expertise, you can create seamless, automated processes for finance and accounting teams, reduce errors, and improve time-to-value by connecting data and apps from ERP, Financial Planning, Procurement, Billing, and Analytics with one easy-to-use integration platform.

To learn more about how you can automate finance processes such as quote-to-cash, watch our on-demand webinar ‘Finance Automation: Automate Key Business Processes with SnapLogic’.