In many finance organizations today, the customary crunching of numbers is performed as in the past, but the exercise has largely been automated. Liberated from rote and repetitive manual tasks, finance teams – and the CFOs who lead them – can focus on what’s most important to the business: executing strategy.

As computing power increases, cognitive computing technologies like robotics process automation, big data analytics, natural language processing, and machine learning are emerging to perform a greater array of transactional tasks in much faster timeframes. Equally if not more important, these tools can unearth real-time business details of vital significance to a company’s strategic success.

Powerful algorithms can cull through an immense volume of external macroeconomic, geopolitical, and competitive market information, as well as internal operating and financial data, to illuminate wide-ranging business conditions as they stand this moment in time. Armed with this information, a CFO can attain functional excellence, rapidly adapting strategy and tactics to make the best of the information at hand.

We live in the age of analytics. Like any epoch in time, there will be winners and losers. Companies that harness digital insights to optimize their products, services, and operations are tomorrow’s winners, their revenues growing at least eight times faster than global GDP, according to a study by Forrester. The losers are the enterprises that fail to implement cognitive computing, or come too late to the party.

Robots aren’t coming – they’re here

CFOs are in the catbird seat when it comes to deploying cognitive technologies. For one thing, the tools are game changing for Finance & Accounting. Moreover, the finance organization has a long tradition of implementing new technologies that make the mathematical underpinnings of their jobs faster and simpler, from hand-held calculators to automated spreadsheets to big data analytics. Lastly, the CFO carries the wallet or purse to pay for these tools.

A 2017 report by Deloitte cites finance as the functional area within a company most often found to invest in analytics, with 79 percent of corporate respondents stating this as the case. Their rationale makes complete sense: machines can analyze dozens of complex financial models in minutes, whereas a human being might struggle to get through a single one in a week. “Cognitive tools can spot a single variance in a billion transactions without breaking a sweat, something a human being could never accomplish,” Deloitte states.

The tools can spot more than a variance, the difference between a budgeted, planned, or standard cost and the actual amount that is incurred. Using powerful algorithms, daily operational and financial data can be distilled into insightful information for strategic and tactical decision-making purposes – on an hourly basis or even less, about as real-time as one can get.

Imagine what can be done with this insight? Production can be aligned more closely with actual demand, inventory can be pared to absolute minimums, and prices can be optimized to generate incrementally more revenue from a specific customer in a certain market or geography. That’s just scratching the surface of the diverse business benefits of real-time analysis.

The tools alone cannot provide this value. Two thoughts come to mind. The first, although others may disagree, is that people are needed to determine which types of data are most important to access, collect, and analyze – good news for people fearing for their jobs. The second is a more technical concern. Data is like water. Without plumbing, it doesn’t always flow where you need it to go.

Reshaping finance

Let’s explore the first challenge first. Certainly, the rise of cognitive computing technologies will disrupt traditional employment paradigms. But this is nothing new: machines have always replaced tasks customarily performed by people, from the Industrial Revolution onwards. The dystopian view is that “work as we know it will soon end” (type those words into a search engine if you’re looking to ruin the day). The truth is more nuanced.

Cognitive computing technologies are tools like any other, used to carry out a specific function. A hammer does nothing without a human arm wielding it. People are needed to deploy and use cognitive tools effectively; otherwise the machines run without purpose. In fact, McKinsey posits that as many as four million jobs worldwide will be created over the next decade simply to interpret machine-produced insights.

In a Finance & Accounting context, cognitive technologies can be designed and engineered to respond to specific questions like yesterday’s sales by region or which products are underperforming this week. In supplying the answers, appropriate and accurate structured and unstructured data must be accessed and integrated. Only human beings with intellectual curiosity and domain expertise can feed the machine to generate immediate insights.

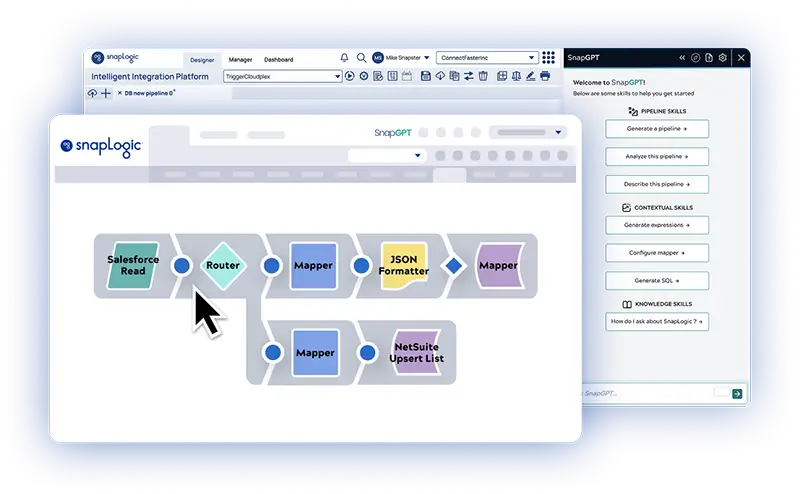

The second challenge gets to the heart of what we do here at SnapLogic. Once the CFO and his or her team have determined which real-time data are crucial to strategy, a robust plumbing system is needed to extract and integrate data from diverse sources into a data lake. Legacy data integration technology can perform this exercise, but not in the timeframe needed to make game-changing decisions.

Modern, cloud-native integration platforms like ours deliver a level of speed consistent with the transformative power of cognitive computing and the decision-making desires of CFOs. Data-driven businesses require a simple but powerful self-service tool that can unify the endpoints of multiple systems, applications, big data streams, data warehouses, analytics tools, and other diverse sources of data – on a single platform. With tools like ours literally hundreds of endpoints can be connected together to integrate millions of structured and unstructured data for analytical purposes.

If data is the new oil, as many have said, we’re the downstream refinery for processing and purifying this precious commodity. A CFO’s strategic and financial decisions depend upon it.