Every month, finance teams gear up for the same challenge: the dreaded month-end close. It’s a high-stakes, high-pressure process that demands speed, precision, and coordination across systems that often don’t speak the same language. Reviewing contracts, checking CRM records, validating billing terms — it’s repetitive, time-consuming work that leaves too much room for human errors.

At SnapLogic, we knew there had to be a better way. So we built and deployed our own Revenue Reconciliation Agent using SnapLogic AgentCreator. It has been live in production for some time now, and is helping our finance team close the books faster, reduce manual review, and recover missed revenue.

This post is part of our Agents in Action series, where we showcase real AI agents built with SnapLogic AgentCreator and the powerful results they’re delivering. In this fourth installment, we take you inside the agent that’s transforming how we reconcile revenue every month.

Watch the Agent Showcase to learn how to build your own Revenue Reconciliation Agent with SnapLogic AgentCreator

The problem with traditional reconciliation

Revenue reconciliation is mission-critical — and notoriously painful. Finance teams are tasked with ensuring that what is in the contract matches with what is actually in the billing system, the CRM, and the ERP. Unfortunely, getting to that point is often a highly manual, time-consuming, multi-step process that involves hunting down signed documents, combing through spreadsheets, and validating important details line by line.

Even with automation, the process has limitations. Tools like optical character recognition (OCR), which convert scanned documents into text, struggle with custom contracts and non-standard formats. Rule-based systems are brittle, breaking down whenever layouts or formats don’t match exactly.

The result? Teams need to spend more time looking for data than using it, slowing down the entire close process and increasing the risk of introducing human errors.

How the Revenue Reconciliation Agent works

The agent was built with one goal in mind: accelerate the reconciliation process without sacrificing accuracy.

Here’s what it does:

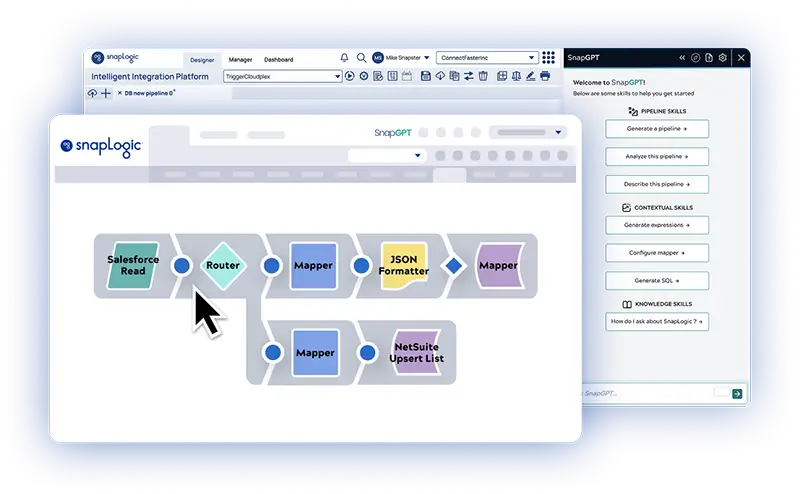

- Monitors cloud storage repositories (like Box) for new contracts files and triggers the appropriate processing workflows

- Uses an LLM to classify whether a document is a standard order form or a custom agreement

- Applies the best suited extraction method for structured parsing of standard forms, or leverages AI prompt-driven logic for unstructured forms

- Validates extracted data (e.g., contract numbers, pricing, dates) against CRM and ERP systems

- Runs a comparison subagent that analyzes results from multiple extraction methods and determines which is most accurate, based on built-in evaluation criteria

- Flags discrepancies for human review before the data is updated

This agent is both fast and flexible. Because it’s built using modular pipelines and tools, it’s adaptable to varying business processes, document formats, and data source changes.

Built for accuracy, designed for scale

This is not a prototype or proof of concept. Our Revenue Reconciliation Agent is live and operational inside SnapLogic and is already making measurable impact to the business:

- Accelerated month-end close timelines

- Reduced manual effort reviewing contracts

- Caught and corrected revenue impacting errors early

- Recouped missed revenue

- Freed up our finance team to focus on more strategic initiatives

We started with a focused goal: eliminate the manual effort of aligning contract terms with ERP data. Once that was solved, expanding the agent capabilities became easy. Since all our relevant data sources were already connected and the pipelines were modular, we quickly extended it to handle new document types, formats, and reconciliation workflows.

By automating what used to take hours or days of manual work, the agent hasn’t just improved speed and accuracy; it’s also improved confidence in our numbers. With fewer discrepancies to chase down and more time to analyze results, our finance team is better equipped to support strategic planning, forecasting, and executive decision-making. It’s a clear example of how AI agents go beyond task automation to unlock greater business agility.

Bring your month-end close into the AI era

Finance teams shouldn’t have to spend days digging through contracts or triple checking data across disconnected systems. And revenue shouldn’t be at risk because of human error or outdated automation.

With Snaplogic AgentCreator, you can build AI-powered agents that reconcile faster, flag inconsistencies, and reduce manual work all without replacing existing tools or breaking business processes. The Revenue Reconciliation Agent is just one example of what’s possible.

Now it’s your turn to create.

Explore what else you can build in our Agent Showcase and see the power of the Revenue Reconciliation Agent in action.

Curious what else you can build?

Explore real-world examples with our Agents in Action series and get inspired to become an AgentCreator.