Originally published on globalbankingandfinance.com.

The race is on for organizations of all sizes, across all industries, to digitally transform. But, this doesn’t happen overnight and there’s no silver bullet for success. In fact, our research uncovered that 40% of enterprises are either behind schedule with their digital transformation projects or haven’t started them yet. This is certainly true in financial services.

Banks are wrangling some of the largest data sets around. Having so much data should be a huge advantage – after all, driving faster and better business decisions based on data is one of the leading benefits of digital transformation. However, our research found that 82% of financial organizations have more data than ever before, but are struggling to harness it to generate useful business insights. Perhaps an unsurprising result considering much of the data within banks lives across disparate, disconnected legacy systems, holding them back from achieving their digital dreams.

Challenger banks entering the market

While traditional banks are held up by legacy infrastructure and unable to reap the immediate benefits of data – in its many forms, from its many sources – there’s been a surge in challenger banks entering the market. From Unity Trust Bank to Secure Trust Bank, these smaller retail banks are taking on the traditional financial institutions and transforming the way we save, manage and spend our cash.

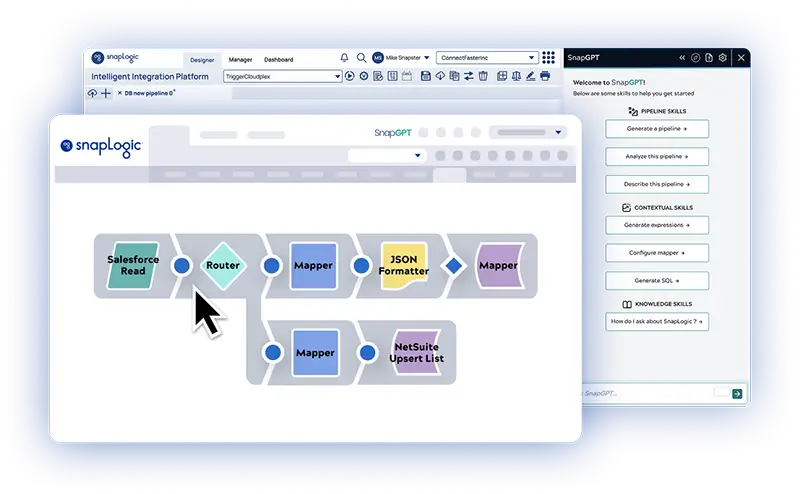

Because they’re not tied to outdated IT systems in the same way traditional banks are, challenger banks are better able to quickly and seamlessly evolve through digital transformation, leveraging new technology such as AI, machine learning, IoT or blockchain to help accelerate their growth and bring in new business. Their ability to quickly adopt new and proven technology has helped them deliver a wide range of new service offerings and customer experiences that consumers have come to expect, and it’s now up to traditional banks to compete with this.

Benefits of the cloud

Many of the new challenger banks and fintech firms are born in the cloud. If you look at the likes of Starling Bank, Monzo and a number of emerging payment providers, they all belong to a new cloud generation of companies, which comes with its benefits. This includes being able to take advantage of the tremendous operational cost savings, nearly limitless data processing power, and the instant scaling options the cloud provides.

For heritage banks, without the right investment in technologies like the cloud, they’ll struggle to adapt. In a move to digitally transform, many will go through a ‘lift and shift” strategy, where they move their on-premises data cluster to the cloud. But historically this has also come with its own inherent issues, and a lot of the challenges with moving big data projects to the cloud have centered on simply getting the right data in the right place – not to mention having the right skilled talent to do so.

Banks that are able to take a step back and remove the complexities surrounding cloud migration and integration means that businesses will finally be able to use their big data project for innovations and deliver business value.

Automation through AI

It’s not only the adoption of cloud that brings benefits. AI and automation technologies are transforming how work gets done across organizations. Analysts estimate that AI will save the banking industry more than $1 trillion by 2030. To capitalize on the automation opportunity, banks are investing in intelligent technologies to automate repetitive business processes, freeing up workers to focus on strategic pursuits that drive the business forward.

Hampshire Trust Bank is an example of a challenger bank that uses AI and machine learning to bring speed, quality, and accuracy to data-driven decisions. By using AI to automate key processes, HTB can enhance the service it delivers for its brokers and customers, helping it to roll out digital initiatives faster. Enterprises must identify where they can put new AI or machine learning technologies to work, and if done right, this will be a powerful accelerant to their digital success.