The time has come to say goodbye to quarterly reporting and quarterly earnings guidance. And not just for the usual reasons cited like short-termism. In this day and age of “real-time everything,” a quarterly reporting cadence is antiquated, pointless and unacceptable.

Public companies seeking money from personal and institutional investors are giving quarterly reports short shrift since they force a wait of three months for financial results. This blindsides investors with bad news the company was cognizant of months before. Just like business decision-makers, investors want transparent information in real time.

Since this level of due diligence is possible today, thanks to automated financial and accounting software and cognitive computing technologies, it makes no sense to bury the truth until three months have passed. It’s also insupportable for companies to have to pay huge fees to auditors every quarter to write up and deliver a report that is outdated by the time of its printing.

Why do these old concepts perpetuate when vastly more modern digital alternatives are available? The answer must have something to do with resistance to change. As we’ve learned from past experiences, change always wins in the long run.

No time for old time

It is increasingly perplexing that a status quo in which investors must wait three months for a company’s financial information to be reported – as if this period of time has a particular magic – continues to be tolerated. And it is downright ridiculous to stick with the practice of quarterly earnings guidance, in which investors must depend on a forecast that is predicated on a long look backwards. In today’s Twittersphere, information is available this instant. Yesterday’s news is fish-wrapping.

No wonder so many CEOs of the Standard & Poor’s 500 responded with nodding heads to the letter that Larry Fink, CEO of BlackRock, wrote them lambasting the longstanding practice of quarterly guidance. Fink has clout – he leads the world’s largest investment firm. As he warned in his letter, “Today’s culture of quarterly earnings hysteria (is) contrary to a much-needed long-term approach.”

Earnings forecasts foster bad behaviors, compelling short-term manipulations to make good on the estimate at period-end, irrespective of the impact on long-term shareholder value. For example, a company might discount the price of its products to reap a windfall at quarter’s end or downsize a department to pare its expenses. These moves have nothing to do with competitive business conditions; they’re just quick remedies to lift the results to match the guidance.

Earnings guidance also troubles Warren Buffett. When it appears to a company that its earnings will miss the forecast, Buffett told CNBC in 2016, “There’s a lot of attempts to find a couple extra pennies someplace … to move earnings toward the end of a quarter.”

Earnings guidance also eats up a lot of time and effort that could be put toward more strategic purposes. Moreover, it’s often wrong. The time is ripe in this period of fast-paced and inexorable digital transformation to reconsider the purpose and value of both quarterly reporting and quarterly earnings guidance.

Real-time realities

Recently, we’ve seen a shift among many midsize and larger enterprises to continuous accounting, using automated financial and accounting software to reconcile accounts, match transactions, and address variances on a daily basis. By day’s end, a snapshot of the organization’s profit and loss is available, offering the means for a “virtual” close of the books, as opposed to the current mad dash at the end of the quarter to do the same.

Well, if the books can be virtually “closed” on a daily basis, there would seem to be no need to file a quarterly report. Why not make the financial information, in some form, available to investors on a transparent basis at the end of each day? If this is doable, and it certainly appears to be just that, it would also obviate the need for quarterly guidance. Companies could leverage cognitive computing technologies to forecast their earnings at day’s end for the benefit of investors and shareholders.

Technology has evolved dramatically in recent years, and here’s how some of these advancements can enable this to work:

- The IoT (Internet of Things) connecting billions of devices will produce an extraordinary volume of structured and unstructured data at unbelievable velocity.

- Using big data analytics, powerful algorithms will dig through a mountain of external macroeconomic, geopolitical, and competitive market information, and internal operating and financial data, to unearth information of import to the business.

- Based on this information, continuous accounting software will calculate the company’s revenues, profits and losses on a daily basis.

- Using deep machine-learning tools – computers that think like human beings at vastly faster rates – forecasts on future earnings can be produced each day, with these estimates adjusted on a routine basis.

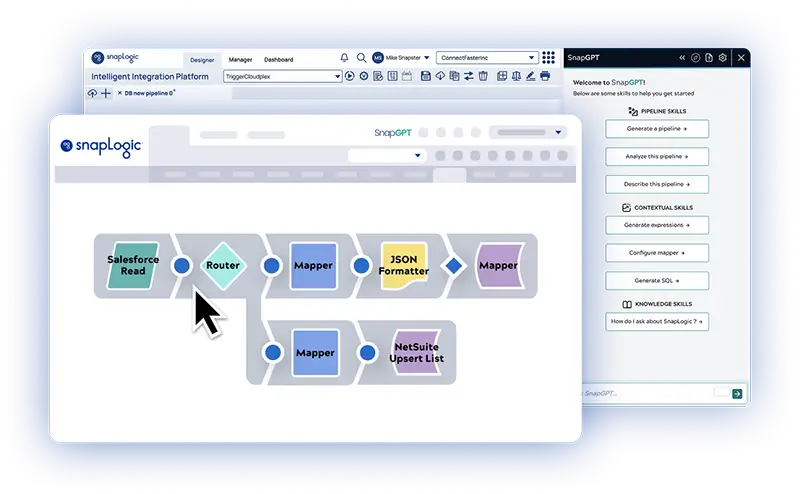

This possible future assumes that the plumbing is in place to move structured and unstructured data from across and outside the enterprise in to a data lake –what we do here at SnapLogic. Our self-service solution brings together the data from multiple systems, applications, , and analytics tools for business use on a single platform.

Machines will still need humans to get the most out of these cognitive tools, which explains why McKinsey predicts that as many as four million jobs worldwide will be created over the next decade to interpret machine-produced insights. In other words, people will be needed to create truly accurate daily reports and estimates that give investors useful information – not weeks-old data, manipulated results, and fictional forecasts.

The sooner the better

This is good news for investors and shareholders. Nobody likes stock prices that rise or fall based on trickery. As Fink put it in his letter, “the powerful forces of short-termism afflicting corporate behavior … remains an issue of paramount importance for BlackRock’s clients, most of whom are saving for retirement and other long-term goals, as well as for the entire global economy.”

Technology can help calm these powerful forces, while assisting company leaders to do what they were hired to do – make adroit decisions that guide the business forward and best-serve its many and diverse constituents. In this environment, the practice of quarterly reports and earnings guidance seems destined for the dustbin.