Secure Trust Bank is an award‐winning retail bank that provides transparent banking to more than a million customers across the UK. The banking group operates V12 Vehicle Finance, a comprehensive, used vehicle offering that makes it easy for car dealers to source, buy, sell, and finance used vehicles for their consumers.

Part of a transformation team at the bank, Tommy Haywood brings in new technologies to support the launch of new products and initiatives that drive growth. To advance new business opportunities at V12 Vehicle Finance, Tommy and his team implemented a new IT infrastructure to ensure their front- and back-end systems were modern, agile, connected, and future-proof.

Watch the video to learn:

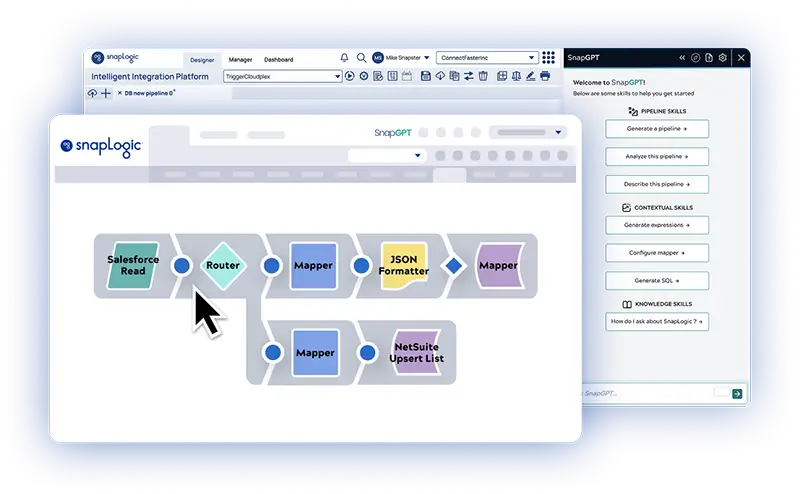

- How Secure Trust Bank has used the SnapLogic platform to connect its back-end lending platform to various payment systems and other cloud-based platforms such as Salesforce

- Why SnapLogic’s low-code, self-service, easy to use platform was the ideal choice for the bank’s lean IT team, helping them easily automate repetitive, manual tasks so they can focus on higher-value projects

- How integrated systems and process automation have helped the bank drive productivity, cost savings, and time to value, helping them reach new markets more quickly and with greater impact