Finance and accounting teams are a foundational department that guides a company’s financial health. Not only do they manage business revenue, billing and invoice processing, third-party procurement, and company expenditures, but they also oversee financial strategy and planning to capitalize on new business opportunities while mitigating risks and costs.

Having a firm grasp of company data – whether related to product, customer, or general business operations – is imperative to the finance department. This critical data, however, is often buried in departmental silos across the business, requiring finance teams to routinely tolerate manual, tedious data entry in multiple systems that consumes time and requires endless double-checking for errors. As businesses strategically modernize systems and processes to move faster, scale-up, and embrace new opportunities, finance is sometimes overlooked as a key function in need of a digital boost.

But companies that recognize the value of setting up finance to work faster and smarter understand that when money flows faster and decisions are made more accurately, it translates to a competitive edge. The key to doing this? Automating end-to-end process workflows in finance.

Automation is the current wave of digital transformation, where all the hard digital transformation work of the last decade is finally being brought together – with the help of AI and other intelligent technologies – to make work more efficient and less costly, and speed up how companies deliver products and services to customers.

Automating back-end finance processes empowers finance teams to obtain the critical data they need at the right time from the right systems. Traditionally, these workflows often require manual intervention if a system is added or removed from the workflows. As a result, financial analysts are left with limited financial insights, additional manual data entry, and more time spent waiting on IT to maintain and update the workflows.

Automating financial workflows to speed up the business

Traditionally, developers have performed integrations manually that typically take weeks to months to get up and running and then require continual upkeep. The end goal has justified the means, but the means has cost companies too much time and ultimately slowed them down.

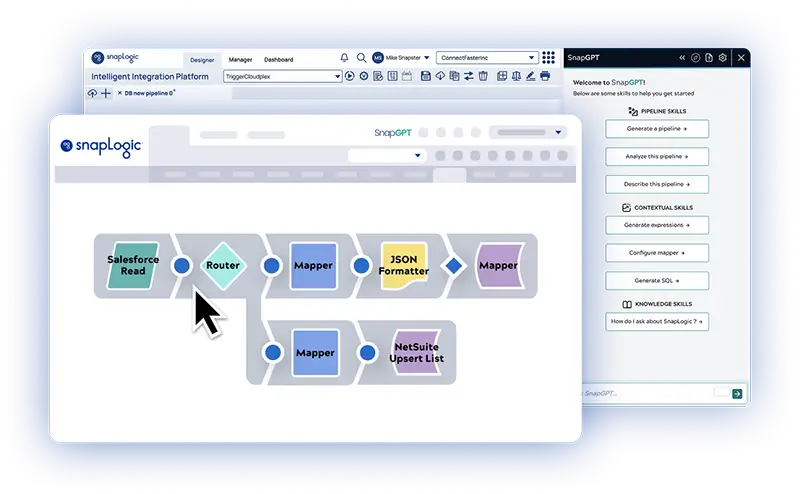

To remedy this, many companies are turning to an integration platform as a service (iPaaS), like SnapLogic, to automate the integration process itself so that connections are made quickly, easily, and auto-updated, freeing developers to focus on more strategic projects.

When you automate the integration process, you can quickly build automations that connect to every app and data source needed that truly give your business an advantage. For finance teams, this means they can eliminate manual data entry, garner data-driven insights for more strategic decisions, speed up finance processes and the flow of money through the business, and help the business move faster and scale quickly.

Get started today by automating these 5 financial processes

- Automate order-to-cash: This is arguably the most important business process in finance in every company – automating cash flows into the company. For example, when a sales rep closes an opportunity in Salesforce, a signed contract for the work order is sent to Docusign, and once the contract is received and confirmed, an invoice is generated in NetSuite. All that information needs to flow seamlessly and without human intervention from Salesforce to Docusign to Netsuite. Once this process is automated, the finance manager can minimize their efforts in manually checking orders and cash flows between systems.

- Speed up data automation into ERP: Finance teams manage accounts receivables and accounts payables whenever the company works with vendors and consultants. As a result, finance needs to compile, track, and compile billings and invoices, as well as onboarding and offboarding consultants and vendors. To minimize redundancy and manual efforts, finance can quickly automate back-end system workflows to connect new and updated data from disparate finance data sources into their ERP system – saving time, reducing manual effort, and improving the experience for all involved.

- Reduce complexity resulting from M&As and consolidations: It’s not unusual for enterprises to have dozens of ERP systems garnered through acquisitions and consolidations, with these systems spread all around the world. These need to connect to the parent company processes and comply with local compliance regulations. By automating disparate data sources, companies can modernize in phases so that as old applications and systems are retired, the process and underlying data is not lost or disrupted. And, with legacy systems integrated to the parent system, it reduces manual data entry and ensures that the parent system gets the data it needs.

- Tie the supply chain to the finance system: Oftentimes, supply chain systems are not connected to the finance system. But when the warehouse needs to check on the inventory for a specific purchase, finance gets involved to find the revenue per SKU, top selling SKUs, which SKUs provide the highest or lowest margin, etc. Connecting the supply chain system to the finance system enables this data to be brought together and readily available to finance when they need it.

- Employ data warehouse automation for financial modeling and planning: Wrangling data from multiple departments like Sales, Marketing, Product, and Customer Service takes far too much time and energy. By integrating data and enabling data warehouse automation, you can move data from all sources into Snowflake, Amazon Redshift, SAP and other data warehouses so financial analysts can query the data they need to do financial modeling for financial planning and revenue forecasting.

These are just a few ways that finance can benefit from automating workflows. Now is the time to consider where your finance and accounting teams need automation to boost their ability to serve the business. Then create automated workflows to free them from tedious, frustrating, and costly manual data entry and harness their deeper value as strategic advisors to the business.

SnapLogic is helping finance teams create the automations they need to modernize their work.