Automation in finance isn’t a novel concept. In fact, a quarter of CFOs surveyed by Vic.ai and StrategicCFO360 in May 2022 reported that their payroll and invoice management process was fully automated, while 45% of respondents were making progress with automating both tasks.

While 61% of those polled recognize the value of automation and 58% plan to increase their investment in automation in the next 12 months, there are still challenges ahead — particularly with implementation.

The study revealed that 61% of CFOs report issues with automation when trying to integrate with existing legacy systems. And while some financial processes have been automated, others are still lagging behind because there’s a gap in knowledge about how these tasks can be automated.

In this post, we’ll help you and your finance team navigate these challenges by diving into the technology behind automation and revealing which finance tasks can be automated. We’ll also provide tool recommendations to help you connect your finance tech stack and automate data flows.

What Does Automation Mean in Finance?

Finance automation is the process of using technology to carry out financial processes that free up time for employees to focus on more high-value tasks.

While the definition of automation remains largely the same across the industry, the implementation can look wildly different.

You could use:

- Simple rules-based automation within a specific platform to complete repetitive tasks

- Robotic process automation (RPA) to carry out resource-intensive tasks across multiple platforms, or

- Intelligent automation to combine RPA bots with artificial intelligence (AI) and machine learning (ML) to solve more sophisticated problems

Read Next: A Quick Overview of Business Process Automation and Its Use Cases

Why Is Automation Important in Finance?

If you’re reading this, you’re already aware of the general benefits of automation: increased accuracy, lower operating costs, and increased productivity.

But finance automation also gives you real-time visibility into your business’s financial health, enabling leadership to make strategic decisions. Financial automation can update reports and dashboards instantly thanks to integrations with marketing, sales, and support tools.

Automatic data collection also tends to be more accurate than manual data entry.

And with financial automation, you can take manual compliance reports out of the equation. Finance automation software can help you stay compliant with different regulatory policies in global markets by automatically generating and sending compliance reports with little to no human intervention.

Different Types of Automation

Financial process automation is chock-full of buzzwords — intelligent automation, autonomous intelligence, and even finance robotics. While these terms seem complicated, understanding the underlying technology can help you understand its capabilities and maximize the output.

Not interested in poring over the details? Skip ahead to the next section to learn which tasks you can automate.

Macros

A macro is a single action or a series of actions that can be performed repeatedly. It can be written with code or recorded.

To create a macro without coding, record your keystrokes and mouse clicks, and then edit the steps. These can be downloaded and shared with the rest of the team.

Sounds complicated? You probably already use macros in Excel. One of the most common examples of an Excel-based macro is to see which accounts are overdue, highlight them in your Excel spreadsheet, and notify the account holder with an email.

Robot Process Automation (RPA)

RPA, or finance robotics, is the most common type of automation. It uses low-code software “bots” to execute time-consuming tasks across multiple platforms. Around 80% of finance leaders have implemented or plan to implement RPA.

Take purchase order (PO) processing, for instance. Traditionally, employees spend a huge amount of time processing purchase orders and then route them to the right person for approval. A software bot can scan POs to gather crucial information, add them to the correct system of record, and send an approval request.

Process Orchestration

Enterprises have many processes that help them achieve specific business outcomes. These processes overlap with various departments and platforms.

Let’s take travel reimbursement as an example. You have to collect those expenses, pass that information to managers and finance teams for review, and then get it approved so the employees get reimbursed.

This sequential set of steps is known as process orchestration.

Doing this manually is inefficient, leads to delays, errors, and ultimately frustration.

Software engineers can redesign the existing structure to create a streamlined workflow. So as soon as employees submit a reimbursement request, the software can automatically send it across for review and notify employees that their request has been approved.

Intelligent Automation (IA)

Intelligent automation is a combination of RPA bots with other technology like AI or ML.

This combination helps scale decision-making with very little human intervention.

So instead of having to manually create financial reports, intelligent bots can identify and collect the data, manipulate it as needed, generate reports, and send them to relevant stakeholders.

If you’re looking to remove the human element completely, the most advanced form of AI — autonomous intelligence — can help. The technology that’s behind self-driving cars can also help complete finance processes without oversight.

How to Decide Which Finance Processes to Automate

As we’ll cover in the next section, there are plenty of financial processes that you can automate. But just because you can automate a task doesn’t mean you should. Just like any investment, the automation’s cost should align with the value that it provides your company.

Evaluate the ROI of the potential automation by first gauging how valuable it would be to your organization. There’s no clear value formula here, but you can ask these questions to figure out the automation’s worth:

- Who currently manually handles this process?

- How long does it take them to complete this process manually?

- How much time would they save by automating this process?

- Based on that time savings, how much money are we saving from a payroll perspective by automating the task?

Use these answers to make a high-level judgment call: would the automation’s value be low or high?

After assessing value, investigate cost. Research a few automation tools and compare pricing. Based on these figures, calculate the likely expense amount.

Compare that figure to the payroll savings that come from the time saved by automating the process. Are the payroll savings greater or lower than the cost of the automation? Based on the answer, determine whether the automation’s cost is low or high.

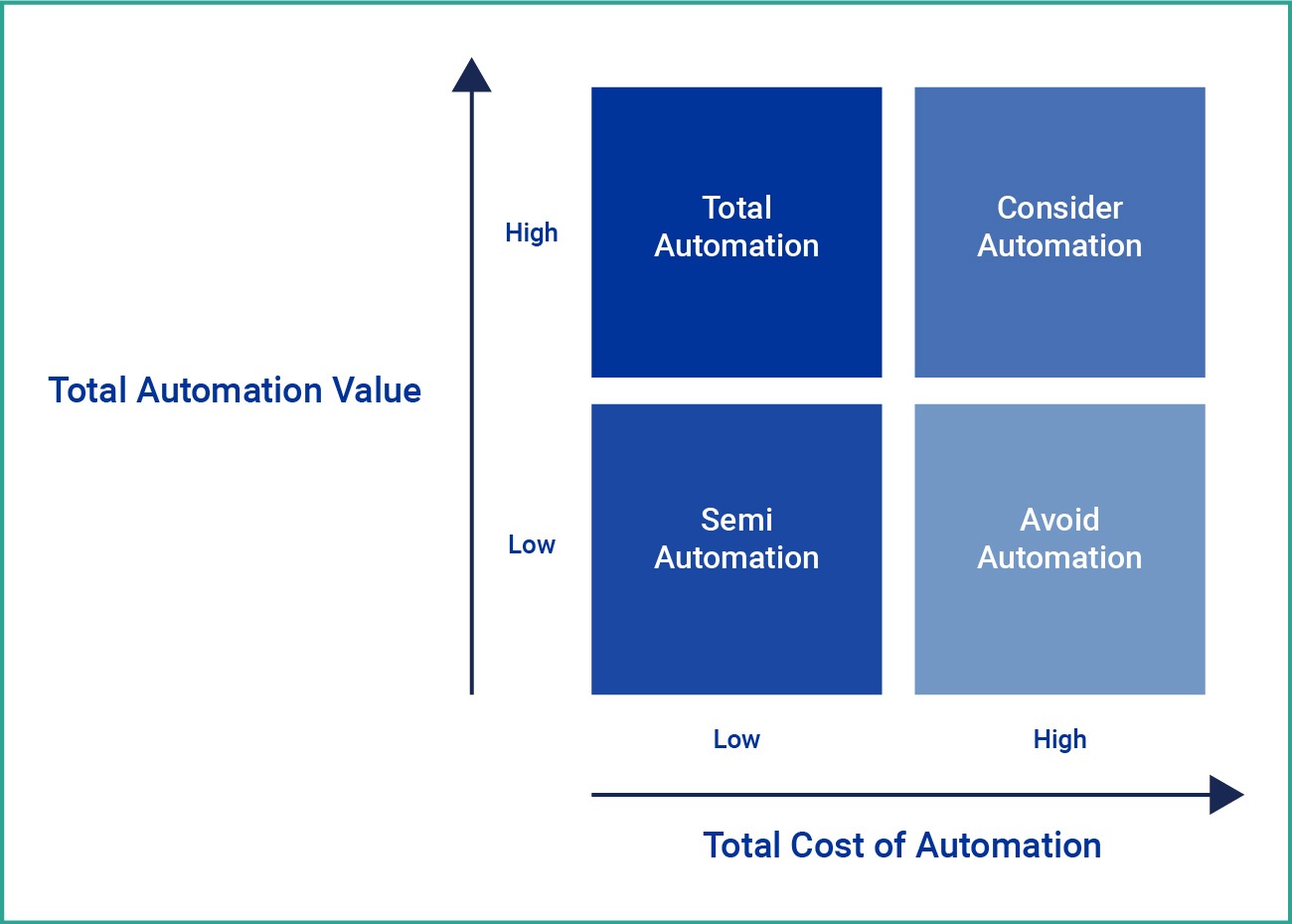

With these assessments for value and cost, use a decision matrix like the one below to prioritize automations.

You’ll end up with one of four outcomes by using a matrix like this.

- Tasks that are low cost and high-value. These financial processes should be completely automated.

- Tasks that are high cost but high-value. These are worth automating, but they don’t have to be your first priority.

- Tasks that are low cost and low-value. These tasks can be automated cheaply but don’t have a large impact, so you can consider automating parts of them.

- Tasks that are high cost and low-value. Typically, you shouldn’t spend your resources on automating these kinds of tasks.

Bucket tasks into these categories so you can prioritize automating low-cost and high-value processes first.

Finance Tasks You Should Consider Automating (+ Tool Recommendations)

Not sure which finance tasks to automate first? Start with this list.

We offer standalone tool suggestions and how you can incorporate these automations into your team’s current tech stack.

1. Bookkeeping

If you haven’t already, consider automating your bookkeeping with tools like Xero, QuickBooks, and Zoho Books. These platforms can automatically help you claim expenses, set up auto-transactions, and reconcile them.

Bookkeeping software can also use machine learning to sort your transactions and accurately organize them into different categories for you automatically.

2. Invoice Processing

MineralTree’s 2021 State of AP Report found that:

- Sixty-four percent of organizations that implement accounts payable (AP) automation process more invoices with the same team size

- Twenty-three percent process the same invoice volume with fewer resources

- Thirteen percent have refocused staff time to other projects

But the same report also revealed that only 9% of organizations have automated their invoicing process end-to-end.

Consider using Tipalti, Oracle NetSuite, or SAP to automate invoice management. You can also automate the entire workflow to send the invoices you receive directly to your enterprise resource planning (ERP) software and trigger communication with the vendor via email.

Here’s a quick look at how you can set it up:

3. Expense Management

More than a third of organizations surveyed in 2021 by Emburse for its Travel & Expense Management Trends Report are still using manual processes to manage their expenses.

Think Excel spreadsheets, “homegrown” systems, or a combination of the two. Manual expense management is vulnerable to human errors, expense fraud, and delayed reimbursement.

Automated expense management software like Ramp, Divvy, and Zoho use a mix of rules-based automation and artificial intelligence and learn your accounting process so it can automatically categorize expenses to speed up the approval and review process. Expense management software can also flag out-of-policy expenses and request a repayment.

However, getting a unified view of expenses across third-party apps poses a challenge. You can build an automation workflow to connect your expense management software to your ERP so all the information can be recorded there. Then, trigger your payroll software so all approved reimbursements can be automatically sent to employees.

4. Month-End Close

Manual month-end accounting isn’t just time intensive. It can also lead to discrepancies between sales numbers and revenue earned, delay reconciliations, and limit visibility without real-time data.

Enter continuous close — a process where all data entries are entered immediately using automation. This accounting approach is a great alternative to month-end accounting because continuous close automation software like Workiva or SAP ensures that your books are constantly updated, so you have real-time visibility and course-correct as soon as you identify a problem.

Learn how to build a continuous close workflow:

5. Inventory Management Process

Using manual processes to track inventory across different tools and spreadsheets is time-intensive and increases the risk of human error. Inaccurate stock data can lead to overstocking, missing shipment dates, and inventory loss due to theft or damage.

Consider inventory management software like NetSuite, Freshservice, or QuickBooks to automatically track, organize, stock, and fulfill orders. These tools offer a real-time view of inventory so you can make critical decisions in real time.

You can also automate the entire workflow to send demand forecasting data to your procurement system so you can place orders ensuring timely fulfillment.

Explore how you can automate your inventory management workflow:

6. Demand Forecasting

Accurate demand forecasting isn’t easy if you stick to manual processes. Plus, manual forecasting takes longer because it doesn’t give you a real-time, unified view of your historical data from all your sales channels.

Demand forecasting (or planning) software like SAP Integrated Business Planning, Oracle Demantra, and Logility help you better serve your customers by predicting long-term needs even in the face of supply chain disruptions. These tools monitor demand, estimate the impact of product launches, and create demand management plans by employing AI and ML.

Learn how you can build a demand forecasting workflow:

Improve Finance Automation With Robust Integration

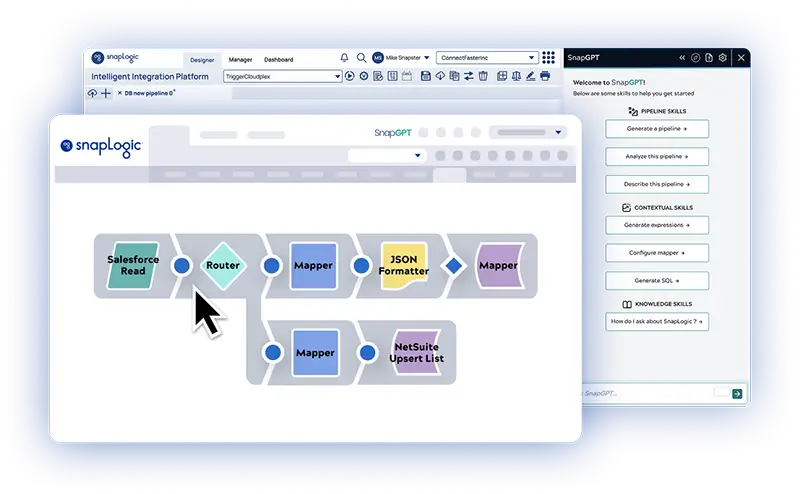

Although most financial software tools offer automation features, these platforms don’t always integrate easily with other tools.

So these automation tools have to be integrated manually by IT teams, which typically takes weeks if not months and requires constant monitoring and upkeep.

Also, each time a new platform is added or abandoned, IT needs to intervene. This means finance professionals have to make additional data entries and have limited insights while the integration or maintenance takes place, defeating the entire purpose of automation.

Get around this challenge by choosing an integration platform as a service (iPaaS) like SnapLogic. An iPaaS solution helps you connect any combination of cloud-based services and on-premises tools to your business data. Your developers can spend less time connecting and maintaining platforms, and finance processes can be sped up as intended.

If you’re interested in learning more about how you can automate your processes, consider downloading this free eBook: Automating Finance Processes for a Faster, More Responsive Enterprise.