Previously published on ITProPortal.

Few narratives have captured the imaginations of business leaders more than robots—bots tirelessly doing work faster than their human colleagues on a 24/7 constant basis.

Leaving aside for the moment the socioeconomic ramifications of robots reducing job opportunities, the fact remains that inventions like Robotic Process Automation, or RPA, make life and work easier, better and more interesting. Bots assume the burdensome manual tasks that people dread doing anyway, handling high-volume repeatable tasks without breaking a sweat. They never need coffee breaks, are never sick, and don’t go on vacations.

One profession (among many) that is benefiting from bots is accounting. Freed from the dreary task of crunching numbers, accountants can better focus on what they have been trained to do in the first place—make sense of financial and operational data to generate better strategic and tactical decisions that move the business forward.

According to Accenture, nearly 40 percent of transactional accounting work will be automated by 2020, liberating accountants to spend over three-quarters of their time analyzing business performance. That’s right: humans still will be needed for more critical thinking tasks.

Other professions are also benefitting from RPA. Companies in highly regulated industries like banks, utilities, and insurance are using bots to ferret out potential compliance issues. Audit firms are leveraging bots to perform more thorough audits, retail entities are applying them to handle customer service and support, and the healthcare industry sees value in having RPA fix its haywire billing system.

On the march

While the bots are assuming jobs performed by people, in the long run, they promise better forms of work for employees—and more jobs, too. Gartner projects that RPA and other forms of artificial intelligence (AI) will create two million new jobs by 2025.

Undoubtedly, all industries will embrace RPA to automate repetitive and mundane rules-based business processes, leveraging algorithms and software to enable business users to devote more of their time to higher-value work. Grand View Research estimates that RPA will be an $8.75 billion market by 2024.

The companies that move forward with these initiatives first will achieve a competitive advantage, via more streamlined and efficient operations, increased productivity, more satisfied customers, and substantial labor savings (the tools are 65 percent less expensive than retaining full-time employees to perform the same work).

However, to preserve this competitive advantage, companies need to overcome a key stumbling block in current RPA software—the connectivity needed between different applications for the algorithms to perform their specific tasks. If connections are slow or broken, the algorithms slow down their pace, limiting the aims of rapid insights. Human intervention is needed to remove the roadblock, obviating one of the key benefits of RPA.

Bots and bottlenecks

Let’s take a moment to explore the technical mechanics of RPA. The simplest definition is to imagine traditional back-office work performed by a human being. RPA essentially replicates these behaviors and activities—opening emails and files, inputting and extracting data, and searching for keywords and phrases.

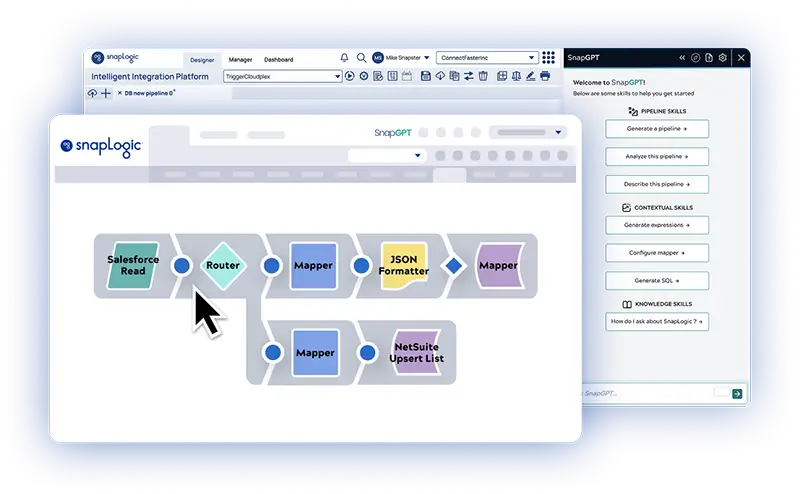

The bots are programmed to do this work. Depending on the specific tasks required, such as processing a transaction or reconciling an account, the software is configured to capture and interpret data from different applications to produce this intended result.

These applications run a wide gamut. In finance and accounting, for instance, they have different apps for accounts payables, accounts receivables, employee payroll, bank reconciliations, the general ledger, and so on. Across the global footprint of a large enterprise are other repositories of real-time and historical data. To close the company’s books for period-end reporting, accountants must extract information from different systems for online sales, warehouse management, customer relationship management, human resources, and supply chain management systems.

That’s a lot of applications and systems spread across the business. But thanks to the use of APIs (application programming interfaces), the different applications can “talk” to each other. But don’t pop the champagne cork just yet.

The challenge arises when all APIs have to be manually coded, which consumes time and requires specialized expertise. If the code connecting two different applications is inexpertly or mistakenly devised, an RPA algorithm will have trouble navigating across this wobbly bridge. As Bill Gates famously said, “automation applied to an inefficient operation will magnify the inefficiency.”

Closer connections

The upshot is clear: The better that RPA bots can connect to APIs, the faster the algorithms can travel. This speed will become more desirable from a competitive standpoint, as it enhances the ability of business users to rapidly extract insights and intelligence useful to decision-making. This is clearly being recognized by leaders in the finance sector. According to a recent survey of 1,700 finance and accounting professionals by Deloitte, their top priority in 2019 is increasing their organizations’ efficiency and internal controls through RPA.

Data integration systems that rely on manual code are at a distinct disadvantage when it comes to smoothing the asphalt for bots to perform their duties. For one thing, they require continual maintenance, resulting in frustrating traffic jams that impede the progress and intent of RPA. To clear the roadblock, humans are called in—a waste of time and effort that should be focused on higher-value activities.

Businesses need to invest in systems that can integrate and maintain up-to-date apps, APIs, and data sources quickly and easily without manual code. Only then can RPA algorithms easily traverse from one application or data source to another (including the endpoints of multiple systems, data warehouses, and analytics tools) to rapidly process a mountain of operating and financial data.

With the right tools and technology, companies across sectors can reap in the benefits, leaving the grunt work to bots and allowing their skilled employees to focus on higher value tasks.